“You are to a politician what a dollar bill is to a banker” - anon.

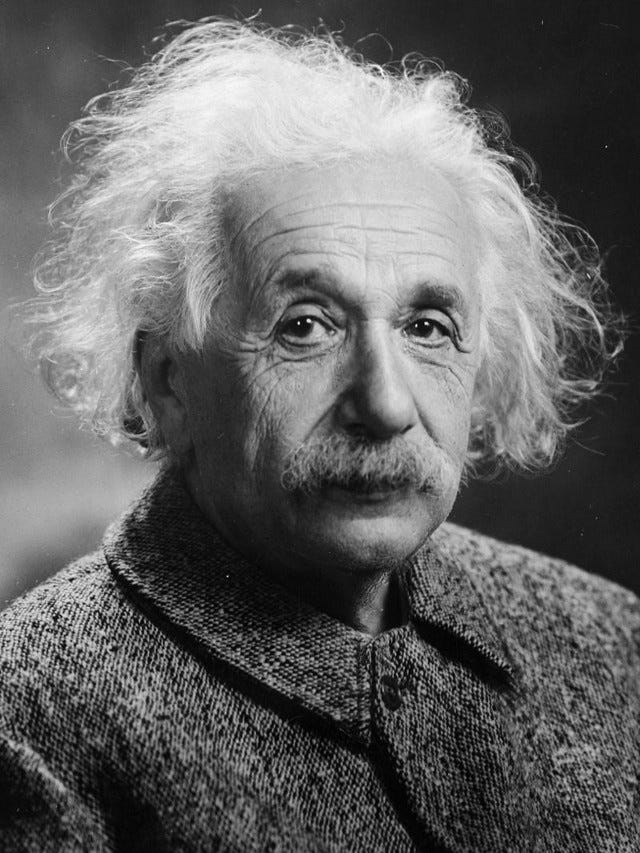

Albert Einstein famously declined the offer of becoming the first president of the new state of Israel when he said:

“All my life I have dealt with objective matters, and hence I lack both the natural aptitude and the experience to deal properly with people and to exercise official function.”

Einstein was smart enough to realise that even though the presidency of Israel was essentially an honorary position, he would find himself being drawn into matters in which he thought he had no competence.

Ah, if only our current leaderships had such wisdom!

The simple truth is that if someone like Einstein – whose name is synonymous with intelligence - didn't believe he could lead a country then where does that leave the rest of us? Well, most of us are wise enough to know that we're not up to it either, even though we may have plenty to say about those who think they are.

Those who enter politics are not that wise.

Fiat Currency

“In God We Trust” - the motto on the US Dollar

“In Gold We Trust” - the motto of others including China, Russia, ...

1864 was a good year to buy gold in Britain. An ounce would have cost you about £2 (£276 in today's money) . Today an ounce is about £1500. Gold hasn't changed its value much – the Pound Sterling has.

Once upon a time the world's reserve currency - the Pound Sterling - was tied to the value of gold. The Bank of England would for nearly two centuries give you an ounce of gold if you gave them 4 pound notes or thereabouts. At about a quarter of an ounce a gold sovereign coin was then more or less equivalent to a Pound Sterling.

Various skirmishes and wars between Britain and just about everyone else moved this up or down somewhat but a pound in 1900 bought you pretty much the same as a pound in 1800. The Victorians could afford their wars because they ran a huge surplus in energy, commodities and manufacturing (in 1850 Britain produced 2/3 of the world's coal and half of its cotton fabric and iron).

The First World War changed all that and impoverished Britain came off the gold standard in 1931. After the 2nd world war destroyed what remained of Britain's wealth and standing the US dollar became the world's reserve currency and an ounce of gold was declared to be worth $35 at Bretton Woods in 1944.

President Nixon took the dollar off the gold standard in 1971 when down-at-heel America could no longer meet its obligations – meaning if everyone took their dollar bills to the US treasury, the gold they'd get back was less than one ounce per $35. The dollar has gone downhill since – you now need nearly 50 times as many of them to buy an ounce of gold.

Dollars, Pounds, Euros and other currencies are known as Fiat currencies. The term 'fiat' means decreed (to be legal tender). A state declares that certain bits of metal, paper, plastic or whatever have value for transactions and that's it. Money is 'created’ by central banks.

A dollar bill is intrinsically worthless – it will provide little heat or light when burned and is no good as toilet paper either. Having a fistfull of dollars doesn't necessarily make you wealthy, or warm, or sanitary.

Fiat currency is trust: you give me a dollar for my day’s work and I trust that I can exchange it in future for equivalent goods. You may want to place your trust in God because placing it in the central bank of the United States or any other central bank is considerably riskier, as we will now see.

In Roman times the Empire's administrators discovered that they could gradually reduce the proportion of silver in the denarius coin (weighing about 4.5 grams). It started at 100% pure silver and the silver content was reduced by a factor of 200 over a few decades. The advantages to those minting the coins were that (1) they cost less to make and (2) they could spend the coins before they had a chance to lose their value.

At the start, 1 denarius would buy a day's labour. If you were that labourer and held on to your denarius for a while then you would have lost out. The trouble with schemes like this is that sooner or later your currency becomes worthless as trust in it is eroded.

It doesn't matter whether your currency is made of metal, paper or electric charges in a silicon chip. The principle of debasement is fundamental to the ability of the elite, in this case the ones who issue money, to extract value from its currency at the expense of its working class. We now call it inflation and it's here in the UK with a vengeance. The reason of course being that our government has been debasing our currency over the past century in order to pay off its debts.

Money and the Panocracy

All societies must have a means of exchange of value. From what we've said above Money has to be:

safe, i.e. trustworthy and able to hold its value. The dollar I earn today should buy the same in 10 years' time.

secure – private and impossible to steal or fake. There are plenty of people who want to steal your hard-earned lucre and not all of them wear masks and carry a bag marked swag.

convenient – easy to carry around and quick to use.

cost-effective– cost less to make than its face value but not much less.

scalable – be suitable for small and large payments – chewing gum or super yachts

fungible – exchangeable without loss: one dollar bill will buy exactly the same as another at the same time

As far as I can tell, no form of money has all these attributes. Central Bank issued money fails at step 1. It's engineered to do this by Central Banks to help politicians pay the debts they run up through bad economic management. It also stumbles at steps 2 and 4: for example a US dollar bill costs about 6 cents to manufacture so it's worthwhile to print them by the shedload. If they cost 99 cents then there would be less profit for those in charge.

It’s too early to say much about digital currencies which have become speculators’ dreams and nightmares.

Bitcoin miners use a lot of electrical energy and this cost is taken to be 'proof of work' – Bitcoins are getting more expensive to produce as there are fewer unmined ones left and energy costs are rising. For example, The Bitcoin network requires about 100Twh per year which is comparable to a small country like Slovenia (pop. 2 million). So it meets condition 4 better than most.

A government backed digital currency would have no such requirement – it would just be magicked up out of some computer somewhere. I presume the excuse will be something like 'all that energy use is anti-green so we're declaring bitcoin illegal'.

OK, so if leading a country is so hard that Einstein wasn't up to it, then just leading a central bank, like that of the United States, the Federal Reserve aka the 'Fed', with a simple remit, must be a lot easier.

Because unscientific economic theory had led to many problems with financial crashes and inflation, the Federal Reserve Reform Act of 1977, required the Fed to direct its policies toward achieving maximum employment and price stability, i.e. zero inflation.

How well they (and their counterparts in other countries) have achieved this is a matter of record. In 2022 it will take $491 to buy you what $100 would in 1977.

Not so well then.

Economics

“If you have n economists in a room then they will have at least n+1 irrefutable theories” - the first law of economists

Money ought to be simple but has been engineered over time into a complicated and influential albatross around the neck of our society. The entire edifice known as Economics has been constructed as part of an attempt to rationalise the often irrational nature of human behaviour.

The problem is that Economics tries to generalise a poorly understood collection of data, good, bad and worse. Economists cannot reproduce economic experiences and their ideas cannot be tested or falsified by rigorous experiment. So Economics doesn't qualify as science, dismal or otherwise.

If anything has become clear from the past few years, it's that attempts to generalise things you don't understand are doomed to disaster.

Economists have foisted on us a menagerie of unreliable, ad hoc and ideological economic theories. That many of those theories happen to chime with certain political ambitions has given economics a pernicious influence on our society.

Money in The Panocracy

“Fed governors are not stupid… at least, not in a conventional way. It took many years of study to become the simpletons they are.” - Bill Bonner

As you will have guessed, I am not an economist. What follows is little more than a guess at what might emerge within a panocracy – which is the same as if I were an economist.

The amount you can borrow from your own bank depends on what the bank thinks you can pay back. There's no real reason why a government or a state should be any different. This should set an annual limit on the amount of money a central bank can issue: no more than the state can raise in order to pay back the debt. This is usually a lot less than politicians wish to spend.

Aside from political palm-greasing, the problem that economists have with limits on money issuance is that it doesn't allow the bank to issue more money in hard times. What that argument ignores is that a central bank free of political influence could issue less money in good times.

I would argue that should be the way that economies are managed – economic surpluses are stored for a rainy day by issuing less money in the good times and more in the bad. The central bank would simply be a money reservoir. It's easier to see how to do this when you don't have spendthrift politicians trying to buy next year's election with the next 5 years' surplus.

A society needn't have a central bank to issue currency. My own country Scotland allows its banks to print money (literally!) and various designs of pound note are in circulation here. A panocracy might decide to do the same. Of course, unlike central banks, private banks can't just issue money at will – they are limited by their reserves, i.e. collateral.

So a panocracy could decentralise its banks to make them responsive to the needs and business cycles of the communities they serve.

Whether the panocracy has a central bank or distributed banks they cannot be allowed to become beholden to political or commercial interests and so cannot be allowed to control base rates of interest. There will be strict rules on what the banks can and can't do – determined by RFCs and approved by vote. So there will be no more stealth taxation via inflation to serve the interests of the government. And let's be clear here, just as happened to the Romans, it's the elites and not the general population whose interests are served by our current monetary arrangements.

So when it comes to repairing our broken monetary system the panocracy - as usual - would get expert advice from a range of economists, business people, financial wizards and ordinary joes like you and me. We'd all put in our 10 cents' worth and the result couldn't help but be a better system (for us) than we have at the moment.

To recap, the principle behind a panocracy is to put political power back into the hands of the people and thus take it away from large organisations - the state and big private corporations - because of its abuse by these bodies.

So the panocracy is an expression of what is currently termed 'populism' and we'll look into its rise next time.